AI Powered Alternative Credit Scoring Platform

Published on 17 Apr 2025

Overview:

Traditional credit scoring models (e.g., FICO) often exclude millions of potential borrowers, particularly those with thin or no credit files. Globally, 1.5 billion people are unbanked, and many banked individuals do not qualify for credit under traditional criteria. These systems create barriers for creditworthy individuals without established credit histories. The AI-Powered Alternative Credit Scoring Platform addresses this by leveraging machine learning (ML) and alternative data sources to assess creditworthiness more inclusively and accurately. This solution aims to improve financial inclusion and risk accuracy where traditional scoring models fall short.

Solution Summary:

This AI-driven credit scoring platform aggregates diverse data sources and uses advanced ML algorithms to generate a predictive credit score. Instead of relying only on credit bureau data, the platform incorporates traditional and non-traditional data like income flows, bill payments, utility records, and online transactions. ML models identify patterns in this data, producing a more accurate and dynamic credit profile for each applicant.

The system delivers an AI-generated credit score and insights, providing real-time indicators of creditworthiness. Benefits include inclusivity (scores individuals with little or no credit history), accuracy (better default risk prediction), speed (real-time scoring), and adaptability (continual updates based on new data). This approach extends credit to underserved borrowers while improving risk management for lenders.

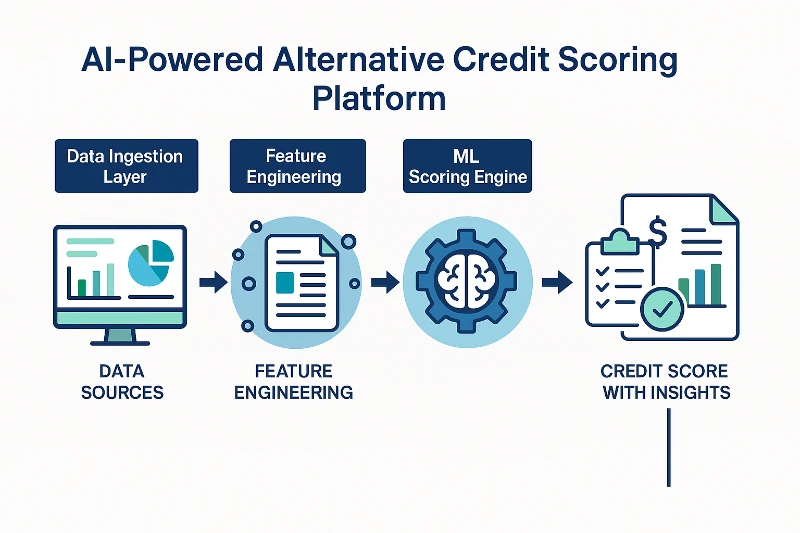

System Architecture:

The platform’s architecture is modular, handling data input to decision output. Key components include:

Data Ingestion Layer:

Collects data from various sources like credit bureaus, bank statements, mobile phone records, and utility payments. This layer ensures data accuracy through validation and normalization.

Feature Engineering Module:

Transforms raw data into meaningful features, such as income stability and payment patterns. It generates a structured applicant profile for the ML model.

ML Scoring Engine:

The core engine analyzes the engineered features and generates a credit score. It uses patterns from past loan data to predict default risk and is periodically retrained to improve accuracy.

Decision Layer:

Interprets the credit score and applies business rules to make lending decisions (approve/reject). It also provides explanations using eXplainable AI (XAI), offering transparency and supporting lenders' decision-making.

Workflow:

Data Collection:

The platform gathers data from various sources (e.g., credit bureaus, bank transactions, utilities) when a loan application is received.

Data Processing & Feature Engineering:

The collected data is cleaned, missing values are handled, and features (e.g., income-to-expense ratios, payment history) are derived.

ML Scoring:

The processed data is fed into the ML model, which generates a credit score and identifies key factors influencing the result.

Decision & Output:

The decision layer compares the score against approval criteria and recommends a lending decision. It also provides insights and reasons for the decision.

Invention Disclosure Summary:

The platform evaluates loan applicants using diverse financial and behavioral data, including non-traditional sources, to generate a predictive credit score. It enables lenders to assess individuals without extensive credit histories, improving financial inclusion and risk management. The system’s components work in a modular pipeline: data ingestion, feature engineering, ML scoring, and decision-making. This cohesive platform offers an intelligent solution for better credit decisions.