Changes have been made to economics, money, and payment methods since the Stone Age. All of these are important barometers of our evolution as a species. Our rudimentary means of doing things reflected our backward way of life. Modern payment systems, driven by state-of-the-art technology, are another example of our technical prowess.

The digitization of monetary transactions was a giant step forward in the quest for a foolproof and infallible payment system. One may make the case that we've accomplished all we set out to do. However, in the last four or five years, there have been tremendous advancements in digital payment systems, and we should expect even more radical shifts shortly.

We'll take a deep look at the technologies, processes, and trends in the digital payment business that are poised to explode in 2023.

See also: Post COVID-19: The Rise or Decline of Fintech?

What are Digital Payments?

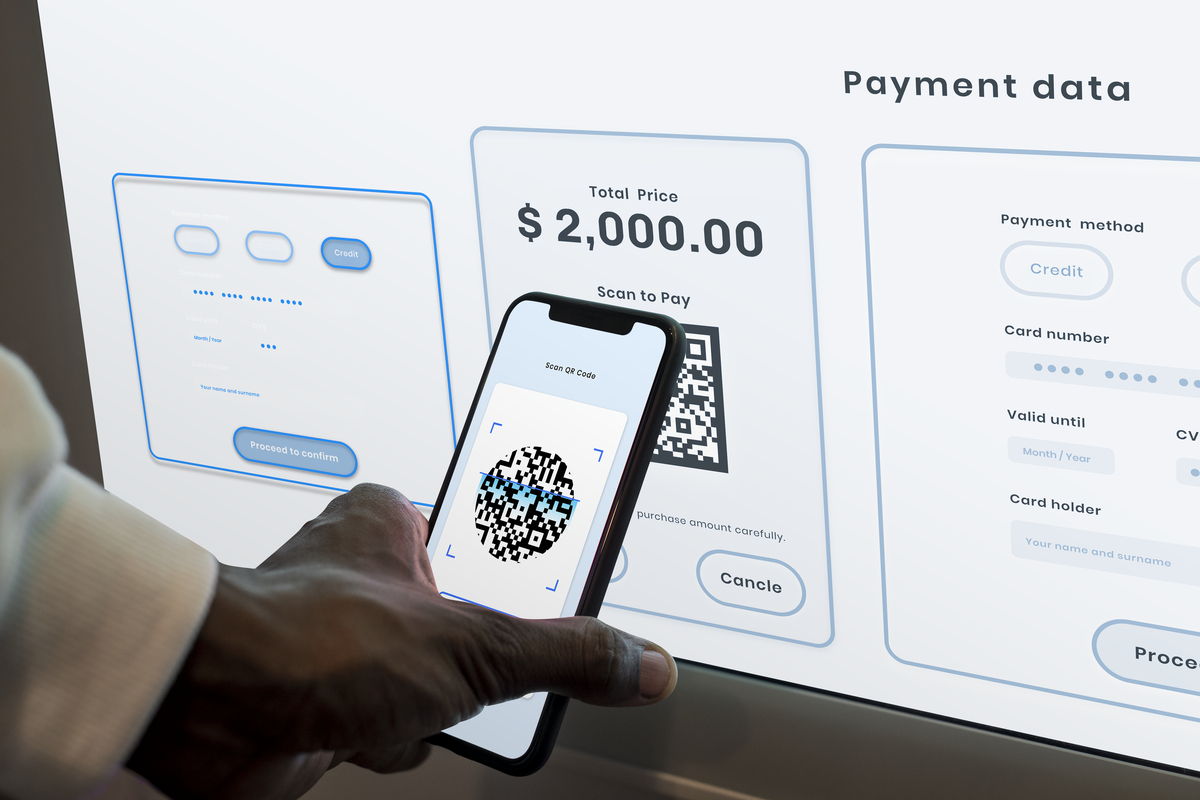

No tangible currency is exchanged during digital payment services since the transaction takes place entirely online. The sender and the receiver of the payment conduct the transaction entirely digitally.

Faceless, paperless, and cashless are just a few examples of digital payments today.

It's important to remember that digital transactions may occur online and offline. For an Amazon purchase, for instance, a digital payment would be made with a mobile wallet. Likewise, if you purchase in a brick-and-mortar shop but choose to use your mobile wallet rather than cash, it also constitutes part of digital payment technologies.

Techniques for Accepting Electronic Transactions

1. Credit/Debit Cards

Cards are frequently used because of their many features and advantages, like payment security, convenience, etc. The most significant benefit of debit, credit, and prepaid banking cards is their adaptability to various forms of electronic payment. Customers may make cashless purchases by storing card information in digital payment services or mobile wallets. Examples of the many widely accepted and acclaimed card payment networks are Visa, Rupay, and MasterCard. Credit and debit cards issued by banks are accepted anywhere debit, and credit cards are accepted, including online, in mobile applications, point-of-sale terminals, and in person.

2. Mobile Wallets

You may utilize a mobile wallet, a digital wallet service, by installing an appropriate app on your smartphone. To make safe transactions, a digital or mobile wallet saves encrypted data from a bank account, debit/credit card, or both. One may fund a mobile wallet with money and use it to pay for products and services. No longer needed to utilize plastic or keep track of a card's verification value or 4-digit PIN. Various financial institutions around the nation have introduced E-wallet services, in addition to the many private companies that have entered the market. Paytm, Mobikwik, Freecharge, etc., are just a few mobile wallet applications. Mobile wallets allow users to transfer and receive money, pay for goods and services online and in-store, and more. There may be a cost associated with using certain mobile wallets.

3. Online Banking

The term "Online banking" describes handling financial transactions over the World Wide Web. Financial services include the sending and receiving of money, the establishment of regular deposits, the termination of accounts, and many more. E-banking, virtual banking, and banking via the internet are all names for the same thing. Customers often utilize NEFT, RTGS, or IMPS when transferring money online via their internet banking. Using a username and password, clients may access their accounts online and take advantage of a wide range of banking services. Banking online is available 24/7, all year round, unlike in-person banking, which has set hours. Internet banking has a lot of potentials.

4. Mobile Banking

One definition of "mobile banking" is using a mobile device, such as a smartphone, to perform banking-related financial activities. With the proliferation of mobile payment systems like mobile wallets, digital payment solutions, and even the Unified Payments Interface (UPI), mobile banking is rapidly growing in breadth. It's now possible to do a wide variety of banking operations with only the tap of a button, thanks to the widespread availability of applications developed by several financial institutions. The phrase "mobile banking" describes the wide variety of financial services that fall under this category.

Top Digital Payment Trends in 2023

Here are the top digital payment trends to follow in in 2023.

Identification using Biometrics

In 2023, biometric authentication will become more common. Biometric authentication makes use of a person's unique physical traits as a means of verification. Fingerprint scanners, face recognition, iris scanners, heart rate monitors, and vein maps are all examples of such verification techniques.

Due to the surge in fraud and identity theft, biometric identification has the potential to become a safe and dependable method for all digital payments made in the year 2023. Statistics also point to this conclusion. According to paymentscardsandmobiles.com, by 2023, card-based spending will reach almost $45 trillion worldwide.

Since it combines and delivers accuracy, efficiency, and security all in one package, biometric authentication is a novel and significant payment technique. Since biometric authentication relies on a person's specific traits, it is a very safe way of verification. This element also contributes to the development of devoted patronage on the part of the targeted audience.

The Technically Advanced Generation Z

Let's back up for a second and define "generation Z" so we know where we're going. Those born between the years 1999 and 2012 are sometimes referred to as "Generation Z" or "Gen Z." Gen Z, or the "digital natives," are the age group between 7 and 20.

In 2022, there were about 2 billion members of Generation Z worldwide, according to mccrindle.com. The repercussions of this demographic transition will be profound. The reason is that by 2022, the bulk of the world's population will have grown up with technology.

This next generation will rely more heavily on state-of-the-art, automated, faster, and more efficient tools and services. This means that next year will be a breakout one for digital payment solutions.

From Cards To Codes

In the beginning, bank cards were only used to verify the existence of an account when a certain sequence of numbers was present. On the other hand, EMV technology (Europay, Mastercard, Visa) has been gaining traction and providing consumers with more automated and secure purchasing methods.

One distinguishing feature of EMV technology is the use of dynamic transaction codes. Using temporary codes is a huge step forward for bank account security. Codes may significantly impact how bank account management is handled, as seen in this example.

Also, innovative payment systems that provide more streamlined ways to transmit and hold money are likely to eclipse the role that plastic cards will play in the future of financial transactions.

See also: Open, embedded, modular, and on a platform: The opportunities of Banking as a Service

Conclusion

Online transactions are the way of the future, and it's imperative to keep up with the digital payment trends. There will be a shift in the coming years away from using real currency and toward using digital payment technologies. There will be numerous shifts in how people make digital purchases before the transformation is complete. These tendencies will be crucial in determining future payment systems' forms. Many of the aforementioned tendencies will also be crucial factors in this operation. But how everything evolves is something only time can reveal.

Featured image: Image by rawpixel.com

Subscribe to Whitepapers.online to learn about new updates and changes made by tech giants that affect health, marketing, business, and other fields. Also, if you like our content, please share on social media platforms like Facebook, WhatsApp, Twitter, and more.